When it comes to protecting your home, what if you could take an extra step that not only provides additional physical protection for your family, but also potentially reduces your insurance premiums? That’s exactly where safe rooms come in.

Safe rooms, sometimes called storm shelters in OKC, are fortified spaces designed to withstand extreme weather events like tornadoes and hurricanes. By adding one to your property, you may be strengthening your insurance coverage and lowering your long-term costs.

Why Insurance Companies Value Safe Rooms

Insurance companies calculate premiums based on risk. The higher the chance of damage, the higher your monthly payment. A home with added protection measures is seen as less risky to insure. Safe rooms can make a big difference in this calculation.

When a severe storm rips through a neighborhood, homes without protective structures often face devastating damage. But homes equipped with storm shelters, including reinforced in-ground or concrete models, have an extra defense against high winds and flying debris. This decreases the likelihood of catastrophic loss, which insurance companies consider when setting rates.

For example, many providers may give discounts for homeowners who install impact-resistant roofing, advanced security systems, or smoke detectors. Similarly, adding a tornado shelter or safe room could be viewed as a protective feature that merits a reduction in premiums.

Which Safe Rooms Are Most Valued by Insurance Companies?

Not all safe rooms are seen equally in the eyes of insurers. The more durable and compliant a shelter is, the more likely it will be considered a true risk-reducing feature.

Insurance companies generally look for storm shelters that meet FEMA and ICC-500 standards, as these are tested against extreme wind speeds and flying debris.

- Concrete storm shelter:Because of their strength and longevity, these are often viewed as one of the most reliable investments. Insurers know that reinforced concrete significantly reduces the chances of collapse or damage.

- In-ground storm shelter:Built below the surface, these offer superior protection from tornadoes and can withstand even EF5 winds. Their proven track record makes them a strong choice from an insurance perspective.

- Underground cement storm shelters:Similar to in-ground models, these provide excellent resistance against natural disasters, which can help homeowners show insurers that they’ve taken serious steps to reduce risk.

- Above-ground garage storm shelters:While above-ground, these are valued because of their accessibility. Insurance providers recognize that quick access means families are less likely to face injury, which reduces potential liability claims.

In short, insurance companies favor safe rooms that are both engineered for storms and easily accessible during an emergency. If you’re considering an upgrade, choosing a FEMA-compliant tornado shelter will not only give your family maximum safety but may also earn you better standing with your insurance provider.

Insurance Savings: What to Expect

While not every insurance provider has an explicit discount for safe rooms, many recognize them as a valuable protective measure. Some companies may offer direct premium reductions, while others may factor the presence of a shelter into a more favorable risk assessment.

It’s also worth noting that insurance companies consider the long-term cost of claims. A family that invests in a tornado shelter is less likely to face devastating losses, which means fewer claims over time. This reliability makes your property more attractive to insure, and can potentially open the door to negotiation on premiums.

Be sure to speak with your insurance agent and ask if they recognize safe rooms as a risk-reducing feature. If they do, you may find that the upfront cost of installing one pays for itself through savings within a few years.

Safe Rooms in Oklahoma: A Smart Investment

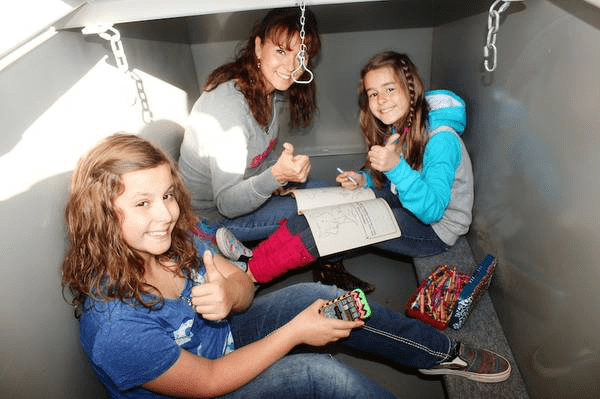

In regions like Oklahoma, where tornadoes are a yearly threat, installing a safe room is essential. Many families, when looking for a house, search for ones with safe rooms because they know the weather can turn dangerous in an instant. In fact, Oklahoma is one of the leading states in safe room installations due to the high frequency of severe storms.

If you’re considering a home upgrade that boosts safety, adds to your property’s value, and may reduce insurance premiums, a safe room is a wise choice. Whether you decide to order garage shelter in Oklahoma, explore premade shelters, or invest in a custom design, the long-term benefits will protect both your family and your finances.

Safe rooms offer peace of mind, add long-term value to your property, and can even enhance your homeowner’s insurance coverage. From underground cement shelters to modern garage installations, there’s an option for every household and budget.

Don’t wait until storm season catches you unprepared. Explore your options and discover how a safe room can protect what matters most.

Ready to take the next step? Contact Oklahoma Shelters to learn more about reliable storm shelters, installation options, and models designed specifically for Oklahoma families. Protect your loved ones and your home today.